|

WATERBORNE PARTNERSHIP

THE

NEED FOR WATERBORNE TRANSPORT TO ACT NOW

Amid growing global and European societal pressure to resolve issues

related to climate change, air pollution and the degradation of the

world’s oceans, political and regulatory attention has been

increasingly directed towards waterborne transport, due to this mode of

transport’s high environmental and climate impact [1.] A number of

major developments are illustrative in this respect:

“The

European Green Deal” (December 2019) [2], to ensure that Europe will be

the first climate-neutral continent, thereby making Europe a prosperous,

modern, competitive and climate-neutral economy, as envisaged in the

Commission Communication “A Clean Planet for All: A European strategic

long-term vision for a prosperous, modern, competitive and climate

neutral economy” (November 20183); The Paris Agreement Objectives (COP21)

[4] and the scientific findings from the Intergovernmental Panel on

Climate Change (IPCC5), which emphasizes the need to limit global

warming to 1,5°C above pre-industrial levels, and related global GHG

emission pathways, in line with the Paris Agreement; The International

Maritime Organisation’s (IMO) Initial IMO Strategy on the reduction of

GHG emissions from ships (April 20186); The EU and global sulphur cap7

as of 1 January 2020; The Central Commission for Navigation of the

Rhine’s (CCNR) Ministerial Mannheim declaration (October 20188);

The calls from the European Council [9] and European Parliament [10] to

enhance the environmental track record of inland waterway transport; The

calls from the European Parliament [11] to reduce global emissions from

shipping and its resolution declaring a climate and environmental

emergency [12] in Europe and globally; The Sustainable

Development Goals (SDG) of the United Nations Development Programme

(UNDP), in particular SDG

9 (Industry, Innovation and Infrastructure) [13], SDG

13 (Climate Action) [14] and SDG

14 (Life Below Water) [15].

The

tell-tale signs and impacts of climate change – such as the rise in

sea level, ice loss and extreme weather – increased during 2015-2019,

which is set to be the warmest five-year period on record according to

the World Meteorological Organization (WMO) [16]. There is an urgent need

to accelerate action. Achieving a net zero-emission waterborne transport

sector by 2050 at the latest, and at least 50% reduction of absolute

emissions by 2030, entails a race against the clock, since the average

age of a modern maritime vessel is 21 years [17], although this is not

uniform across vessel types. Therefore, the transition towards

zero-emission waterborne transport will need to address existing, as

well as new-build ships. In addition, it will not only require research

and development regarding (the use of) alternative fuels, but will also

have to take into account all means to radically improve the ship’s energy

efficiency and related emission efficiency (both retrofitting and new

build).

As

well as making seagoing ships and inland vessels zero-emission, the

transition towards zero-emission waterborne transport will also require

changes to infrastructure, ship design, shipbuilding processes, maritime

equipment production, ports, alternative fuel terminals and processing

plants, the wider logistics chain and more energy-efficient operations.

Measures will also need to be taken in different action areas such as

digitalisation (e.g. to allow better energy monitoring and to increase

energy efficiency) and the education and training of the current and

future workforce in order to ensure that the implementation of new

technologies and concepts is properly executed. To put this ambition and

commitment into practice whilst taking into account the timelines set

out in various regulations, there is a need to start the transition

process now. In order to achieve true net zero-emission waterborne

transport, the waterborne transport sector is determined to address all

environmental challenges in an integrated manner, whilst prioritizing

the impact on climate

change, research, development and innovation will address the

ambition to eliminate the entire environmental footprint of waterborne

transport.

POLICIES & REGULATIONS

Whilst the threats and risks of climate change and the harm from air

pollution are known, policy actions have often failed to keep pace,

despite increasing societal demand. To address this, the European

Commission presented the European Green Deal in December 2019 with

the objective for Europe to become the world’s first climate-neutral

continent by 2050, through the provision of a package of measures, which

should enable European citizens and businesses to benefit from a

sustainable green transition. The Green Deal sets out the Commission’s

commitment to tackle climate and environmental challenges. To achieve

climate neutrality, the European Green Deal envisages cutting transport

emissions by 90% by 2050 at the latest. In addition, it lays down the

ambition to reduce GHG emissions by at least 50% by 203018. This

communication builds upon a clear strategic long-term vision for a

prosperous, modern, competitive and climate neutral economy (A Clean

Planet for All), as communicated in November 2018. This strategy confirms Europe’s

commitment to lead in global climate action and to present a vision that

can lead to achieving net-zero GHG by 2050 through a socially fair

transition carried out in a cost-efficient manner. It defines pathways

for the transition to a net-zero GHG economy and strategic priorities.

Seven

main strategic building blocks to achieve the objectives of this vision

have been defined by the European Commission and “clean, safe and

connected mobility” is one of these [19]. In March 2020, the European

Commission adopted a proposal to enshrine in legislation the EU’s

political commitment to be climate neutral by 2050, to protect the

planet and EU citizens 20.

The

European Climate Law establishes a framework for the irreversible and

gradual reduction of greenhouse gas emissions and it addresses the

pathway to achieve the 2050 target. The Sustainable and Smart Mobility

Strategy, part of the European Green Deal, must set out the European

Commission’s approach to delivering the transport sectors contribution

to the goal of climate neutrality by 205021. The FuelEU Maritime –

Green European Maritime Space initiative planned for 2020 aims to

accelerate achievement of low-emission, climate neutral shipping and

ports by promoting the uptake of sustainable alternative energy and

power [22].

At the international level, IMO’s Marine Environment Protection

Committee (MEPC) adopted an initial strategy for the reduction of GHG

emissions from (seagoing) ships in April 2018, setting out a vision to

reduce GHG emissions from international shipping by at least 50%

compared to 2008 figures by 2050 and to phase them out as early as

possible this century.

When

the strategy will be reviewed in 2023, the level of ambition is expected

to be considerably increased, not at least in light of recent scientific

reports like the IPPC “Global warming of 1,5°C” report [28]. In

October 2016, the IMO MEPC also adopted the decision to reduce the

sulphur content of marine fuels down to 0.50% as of 1 January 2020 in

order to address the negative effects of related air pollution on health

and the environment.

Furthermore,

the Sustainable Development Goals (SDG) of the United Nations

Development Programme (UNDP) emphasize the importance of investments in

infrastructure to achieve SDG 9 (Industry, Innovation and

Infrastructure), call for urgent action to combat climate

change and its impacts SDG 13 (Climate Action) and underline the

need to conserve and sustainably use the oceans, seas and marine

resources SDG 14 (Life Below Water).

The

changing climate is already exposing waterborne transport and the entire

maritime economy to multiple risks, which require significant investment

in resilience-strengthening measures. Without urgent climate change

mitigation action, the global sea level rise will be accelerated and the

frequency of extreme marine events, such as marine heatwave and tropical

cyclones, will increase, as stated in the latest IPCC Special Report on

the Ocean and Cryosphere in a Changing Climate (November 201929). Low

water levels in European rivers are affecting the economy as well.

Although Germany enjoyed an overall increase of its GDP in 2018 (+1.5%),

this could have been higher if Germany’s waterways had not experienced

low water levels. Sinking water levels on Germany’s rivers (used to

transport industrial goods) probably shaved at least 0.7 percentage

point off economic growth in 2018 [30].

Industrial

commitment and competitiveness Turning to industry, in January 2019 the

Waterborne Technology Platform launched its vision regarding

zero-emission waterborne transport in 205031, whilst – in addition –

an emerging number of maritime and inland ship-owners have set net-zero

CO2 emissions in 2050 or earlier [32] as their target [33]. The European

waterborne transport sector welcomes the European Green Deal and is

committed to reaching its objectives [34]. An initial group of

shipowners have indicated that their fleet will be emission free in

2050, stating that RD&I will be key to reaching this objective [35].

The European maritime technology sector annually invests 8-9% of its

turnover in RD&I36 and is fully committed to develop the solutions

needed and to invest accordingly [37].

The waterborne transport sector is strategic for Europe form an

essential transport route for the global and intra-continental trade

flows and are places for living and recreation. Although less visible,

waterborne transport is essential for the functioning of modern

economies. Principally the most energy-efficient form of freight

transportation, the quantity of goods moved by ship will not fall and is

expected to increase in line with developing economies and global

growth. In addition, waterborne transport is an essential means of

passenger transport as well. For example, ferries are often key for

local transport. Each year, more than 400 million passengers embark and

disembark at European ports [43]. It is challenging to address this global

growth whilst the globe strives to decarbonise every aspect of daily

life. As a matter of priority for the European Green Deal, a substantial

part of freight carried by road today should shift onto waterways to

boost multimodal transport and the efficiency of the entire transport

system. The urgency to reduce emissions, the conservation of resources

and the need to use resources carefully are driving the increase of

energy-efficiency.

Furthermore,

there will be a growing demand for clean energy – not only from

shipping - that is expected to be more expensive and may be less

available than their fossil alternatives. Increasing the

energy-efficiency will be a key driver for waterborne transport.

European-based

maritime shipping companies control around 36% of the global fleet [44].

The European maritime technology sector is a global leader in

high-technology shipbuilding (for example maritime and inland cruise

ships, electric ships, offshore support) and green shipping technologies

treatment systems, green equipment and smart technology for improved

efficiency and operations). European companies supply almost half of

global maritime equipment and have developed and designed the majority

of the world’s fleets’ power systems. For two-stroke main engines,

the market share of EU-designed engines was over 90% between 2015 and

2019. For medium speed main engines, this was around 70%45. The

achievement of zero-emission waterborne transport not only represents a

major challenge to Europe’s waterborne transport sector, it also

offers an excellent opportunity to further enhance its global

competitiveness. This means that strengthening the EU's expertise in

zero-emission technologies will enable European companies to provide

innovative solutions to achieve the transition towards zero emission

waterborne transport. It will also enable European companies to compete

in new markets and to regain lost markets which are currently dominated

by competitors from the Asian regions.

A

prime example is the equipment delivery for, and construction of,

merchant ships such as bulkers, tankers and general cargo vessels, as

well as ferries which, until recently, were mainly built in Europe.

Challenge to transform to a zero-emission mode of transport:

environmental impacts of shipping In 2018, more than 130 million tons of

CO2 were emitted from seagoing ships above 5,000 gross tonnage visiting

European ports46, which represented over 13% of total EU transport

emissions [47]. Globally, shipping annually emits around 940 million

tons of CO2 [48], which accounts for 2-3% of total GHG emissions [49].

Over two-third of the GHG emissions from ships sailing to or from

European ports originates from container ships, tankers, bulk carriers

and passenger vessels [50]. To put this in perspective, if shipping was

a country it would be the 6th biggest GHG emitter in the world. If no

action is taken, these emissions are expected to increase by between 20%

and 120% by 205051 (or by between 50% to 250% according to the third IMO

greenhouse gas study [52], which will be soon updated), driven by

economic growth and the resulting increased demand for transportation of

goods and people.

RADICAL CHANGE

Radical change is required in order to be able to meet the 2050 climate

targets, the 50% - 55% reduction of emissions by 2030 in line with the

European Green Deal, as well as reduction of harmful air pollutant

emissions, and this will not be possible through operational changes and

incremental improvements alone. New technologies need to be developed

and deployed very soon.

SCALE OF THE PROBLEM

Waterborne transport is one of the most efficient modes of transport in

terms of CO2 per ton kilometer. However, due to its large scale, it

still generates a substantial amount of emissions and each year seagoing

ships consume around 300 million tons of fuel, emitting approximately 1

billion tons of CO2,

which is similar to global aviation [59]. In addition, as a result of

residual fuel oils and the emission levels of existing older ships,

it is a major source of air

pollution, particularly within coastal and

port areas with a high density of population, but also on the mainland

along inland shipping routes, since as air pollution travels long

distances. Shipping accounts for 18 to 30 % of the nitrogen oxide (NOx)

and 8% of the sulphur oxides (SOx)

of total global air emissions [60]. Just 15 of the biggest ships emit

more of the noxious oxides of nitrogen and sulphur than all the

world’s cars put together [61]. Without any action being taken, by

2030 NOx emissions from shipping will exceed those from land-based

sources in the EU [62]. Maritime shipping also impacts water quality

due, for example, to oil spills, sewage discharges, spreading invasive

aquatic species in ballast water, use of toxic hull coatings to avoid

fouling, discharges from exhaust treatment systems, etc. Noise is

impacting citizens close to shipping routes and destinations and

underwater noise is impacting marine mammals and other marine

species [63].

CARBON DIOXIDE EMISSIONS

European CO2 emissions from shipping are a major challenge. In 2018,

more than 130 million tons of CO2, or around 13% of total EU transport

emissions, were emitted from maritime ships over 5,000 gross tonnage

visiting European ports. International and domestic shipping dominates

CO2 emissions, whilst inland waterway transport cannot be ignored. The

EU project, PROMINENT, calculated that inland waterway transport in the

EU results in 3.8 million tons of CO2 emissions per year [64].

The world is not on course to achieve a temperature increase of well

below 2°C and therefore urgent action is needed. Even if the energy mix

used for waterborne transport is changed in accordance with the

objectives of limiting the temperature increase and the economic

developments are commensurate with this goal, shipping emissions are

projected to increase by 20-50% between 2008 and 205065 (or by between

50%-250% according to the third IMO GHG study, to be updated in 2021).

Increasing the energy efficiency of ships has its limits and would not

be sufficient to meet either the 2050 level of ambition of the European

Green Deal or the targets of the Initial IMO Strategy on Reduction of

GHG Emissions from Ships. Only a combination of zero-emission innovative

solutions, fuels, operational approaches and technologies, triggered by

ambitious regulations, can bring about the change needed.

SOX, PM & NOX EMISSIONS

Emissions of sulphur dioxide (SOx) from maritime transport affect air

quality in the EU and globally. SOx emissions result from the onboard

combustion of oil-based fuel products and are directly linked to the

sulphur content in marine fuels used in maritime transport [66]. SOx

emissions are a precursor of PM2.5 and a major cause of acid rain.

According to the European Environment Agency, shipping is responsible

for 11.05% of EU NOx emissions and 11.05% of SOx emissions [67].

Nitrogen Oxides (NOx) form smog, acid rain and eutrophication and are

central to the formation of fine particles (PM2.5) and ground level

ozone, both of which are associated with adverse health effects,

including premature deaths. Concentrations of air pollutants from

shipping can be much higher in coastal and port areas where it can be

the dominant source of air pollution. While current IMO and EU

regulations will reduce SO2 emissions from international shipping from

2020, emissions remain much higher than other transport modes. After

2030, NOx emissions from shipping are set to exceed all EU land-based

sources [68].

The sulphur in fuel requirements that have been agreed by the IMO will

cut SO2 emissions by 50-80 percent up to 2030, but in the absence of

additional regulations, emissions will rebound afterwards. CO2 and NOx

emissions are expected to further increase without additional measures

[69]. The IMO has designated the North Sea and the Baltic Sea as a NOx

Emission Control Area (NECA) starting from January 1 2021. According to

recent estimates by the European Monitoring and Evaluation Programme (EMEP),

consisting of deposition modelling based on available emission

scenarios, the annual reduction in total Nitrogen deposition in the

Baltic Sea area will be 22,000 tons as a combined effect of the Baltic

and North Seas NECAs and compared to a non-NECA scenario. However, a

lengthy period of fleet renewal is needed before the regulation will

show full effect, according to HELCOM (Baltic Marine Environment

Protection Commission) [70]. Thus illustrating the need for retro-fittable

technologies as an essential tool to meet policy objectives.

Inland

waterway transport plays an important role in the transport of goods in

Europe. More than 37,000 kilometres of waterways connect hundreds of

cities and industrial regions. Thirteen Member States have an

interconnected waterway network. The potential for increasing the modal

share of inland waterway transport is significant [71]. Inland waterway

transport, however, should act urgently to increase its sustainable

advantage. Passing through the centre of towns and cities, an inland

waterway vessel will produce approximately 11,000 kg of NOx per year,

whilst a modern diesel car within the same area may produce less than

1kg of NOx per year. Other transport modes are becoming cleaner and

inland waterway transport faces the risk of falling behind. Studies have

analysed average emissions of IWT vessels on tonne-kilometres (as in the

PROMINENT [72] project).

PROMINENT calculated that 1.3 million m3 of gasoil fuel is consumed per

year by inland waterway transport in the EU, resulting in 3.8 million

tons of CO2 emissions per year, 51 kilotons of

NOx and 2.2 kilotons of

PM. The total external costs74 caused by the emissions to air add up to

1.09 billion EUR, of which 825 million for NOx, 140 million for PM and

126 million for CO2. It should be noted that inland waterway transport

has been using low sulphur fuel since 2011.

HULL COATINGS

Ship hulls and marine structures are coated to prevent sea life

attaching themselves, thereby increasing friction, slowing down the ship

and increasing fuel consumption. The fuel savings made by limiting the

adhesion of marine organisms has been estimated to be $60 billion

annually, reducing GHG emissions by 384 million and SO2 by 3.6 million

tons [80]. However, the antifouling compounds used may "leach"

harmful substances into the sea, damaging the environment and possibly

entering the food chain.

STRATEGIC IMPORTANCE OF SHIP BUILDING

The maritime transport sector directly employs over 685,000 workers at

sea and on shore [81]. It supports 2 million workers through indirect

and induced employment. The EU maritime shipping industry contributes a

total of €149 billion to the EU’s annual GDP [82]. EU companies own

36% of the world fleet, the largest single share in 201883. Europe has

300 shipyards, the largest of which build the most complex, innovative

and technologically advanced civilian and naval ships and platforms in

the world. Technologies for these ships form the basis for advanced

zero-emission technologies to be further adapted for other ship types.

Others maintain, convert, repair or retrofit existing (merchant) ship

types. A third category builds, repairs or maintains smaller vessel

types or boats. Together, these yards generate annual production worth

€42.9 billion and directly employ 285,000 people (EU28) [84].

Moreover, for each job they create, another six jobs are created in the

supply chain.

Almost

half of marine equipment is produced by European companies, including

over 70% of the world’s large marine engines. The majority of the

European marine equipment sector are SMEs. With an annual production of

€44.5 billion, the equipment sector produces and supplies all types of

materials, equipment, systems, technologies and services. The companies

can be global, regional or local players. Europe’s maritime equipment

companies are the leading providers of solutions to combat climate

change, to minimize marine pollution and to make shipping better

connected, more digital, automated or even autonomous.

Approximately

4 billion tons, representing 75% of all goods, and 415 million

passengers pass through EU ports each year. Ports are not only essential

for the import and export of goods, but they also constitute energy

hubs, bringing together infrastructure managers, shipping companies and

energy suppliers who contribute to the uptake of electricity and clean

fuels. Ports also link maritime transport with the hinterland through

the different land transport modes, including inland waterways. Ports

generate employment: 1.5 million workers are employed in European ports,

with the same amount employed indirectly across the 22 EU maritime

Member States [85].

Europe’s long-standing leadership in the maritime sector is coming

under pressure. The EU’s share of worldwide shipbuilding is also in

decline. Europe’s current global leadership position in maritime

technology is once again challenged by Asia. This time, South Korea and

China in particular have identified complex shipbuilding, as well as

advanced maritime equipment, as new markets for themselves. They are

therefore applying dedicated sectoral strategies which contain the same

well known “toolbox” of government-led policies, financial

incentives (including massive state aid) and unfair trade practices, as

the one that had already helped them to successfully conquer Europe’s

merchant shipbuilding and partly Europe’s offshore building industry.

Consolidating and further strengthening the EU’s frontrunner role in

RD&I and implementation of greening technologies and concepts will

be essential to ensure the transition to a clean and competitive

European waterborne transport sector and to enhance the competitiveness

of the European sector across all market segments.

PREVIOUS EU FRAMEWORK PROGRAMMES

FP7 and Horizon

2020 invested around 50 million EUR per year, enabling support to be

provided each year to two to three topics to address all aspects of

waterborne transport research. Addressing decarbonisation and

environmental impact accounted for a substantial part of these research

efforts. Nevertheless, these investments were insufficient to enable a

coordinated programme of actions to tackle the urgent climate and

environmental challenges facing the sector. In 2019, the EU’s European

Political Strategy Centre report, “Clean Transport at Sea”86, called

for more ambitious and coordinated R&I investment in Horizon Europe

to address the environmental challenges encountered in the sector.

Under

Horizon Europe, there is an urgent need to upscale and accelerate

activities to reduce GHG emissions by at least 50% by 2030 and to phase

out GHG emissions completely before 2050. Considering the sector’s

diversity and the urgent environmental challenge, it is essential to

mobilise a critical mass and to leverage coordinated private and public

investment. Currently, the investments being made to address the

diverse challenges which have to be met to decarbonise are insufficient

(e.g. just one topic in 7 years of Horizon 2020 regarding decarbonising

long distance shipping). This urgency for action and the need for the

Co-Programmed Partnership zero-emission

waterborne transport in this perspective, was recently highlighted in

the Ministerial Declaration on the future outlook of EU Waterborne

transport [87].

R&D INNOVATION BOTTLENECKS OR MARKET FAILURES

by 2050, a radical change from “business as usual” will be required.

Specifically, (EU) research and innovation will need to target new

solutions, including new - potentially disruptive - technologies,

including solutions which might only be applicable for certain segments

of the waterborne transport sector. Furthermore, the focus should shift

from the current fossil fuels to climate-neutral, sustainable

alternative fuel solutions for which, moreover, adequate infrastructures

(e.g. in ports) need to be put in place. For these alternative fuels,

the respective technologies and relevant infrastructure are not yet in

place for waterborne transport. Furthermore, and in view of the long

lifetime of ships, to achieve these ambitious goals, the waterborne

transport sector will not only have to develop and build new

zero-emission ships.

1.1.5

THE UNDERLYING RESEARCH, INNOVATION, DEPLOYMENT OR SYSTEMIC BOTTLENECKS

AND/OR MARKET FAILURES THAT ARE TO BE ADDRESSED BY THE PARTNERSHIP

To

accelerate deployment of zero-emission technologies, it will also need

to develop solutions to retrofit existing ships. Ships that will join

the fleet in the coming years, will have to be designed with future

retrofitting to green technologies in mind, allowing for maximal uptake

of new emerging technologies. For ships that are already existing now,

the retrofitting process is likely to be the most complex and difficult

part in the transition towards zero-emission waterborne transport.

Retrofitting also concerns reducing polluting emissions in line with the

European Green Deal, as well as cutting GHGs. Therefore, considering

that ships now entering service could be operational until 2050, there

is an urgent need for the development of effective, efficient and

affordable deployable solutions. Decreasing the energy use of waterborne

transport will be key as well, both in terms of reducing GHG emissions,

as well as in order to ensure economically viable solutions. With the

prices of alternative fuels probably being relatively expensive compared

to fossil fuels, energy savings will be crucial. All these efforts will

have a positive impact on the modal shift to waterborne transport as

well. On the one hand, by being a sustainable and climate-resilient mode

of transport and thereby a preferred one. On the other hand, solutions

deployed in our aim to reduce the energy needs will also increase the

integration of waterborne transport in the entire logistics chain. Due

to the wide range of ship types and waterborne transport services, there

is currently no clear, single path to decarbonisation [88].

SYSTEMATIC BOTTLENECKS - SME'S & FUNDING

Since it is highly diversified, the waterborne transport sector consists

of many different segments, with - in turn - many sub-segments, which

have different interests, challenges, opportunities and needs. This

diversification is not only a wealth for the sector and society at

large, it is also a bottleneck for the sector. The lack of a clear path

towards zero-emission waterborne transport entails a high risk for

individual companies to invest in RD&I activities. In addition, the

specialised and competitive nature of the industry results in a large

number of SME companies with limited access to research funding.

Consequently, European research and innovation for the waterborne

transport sector plays an essential role to increase coherence and to

develop concrete solutions.

Regarding the shipowners, the shipowner and the charterer have diverging

interests and this often results in complex decision making about future

investments. In the inland waterway transport sector, the majority of

the shipowners are SMEs (family owned vessels), with limited investment

capacity, leading to hardly any renewal or investment.

DEPLOYMENT BOTTLENECKS

Deployment of the outcomes of RD&I is hampered by the high capital

cost of waterborne transport systems and consequently the risk of being

a first adopter of a new technology or solution. This can be further

exacerbated by a regulatory framework which assumes the presence of

existing technology, as well as a conservative and reactive culture

amongst the sector. EU RD&I activities and their communication

provide the technology demonstration needed to provide assurances

concerning the take up of new solutions, as well as a foundation for EU

and global regulation.

One example is the implementation of LNG as a cleaner marine fuel; its

development was hampered by a lack of regulatory safety to enable ships

to sail using the fuel. Also, no fuel bunkering infrastructure was

available and this, in turn, delayed demand to build LNG

powered vessels. In addition, whilst LNG is a cleaner results in complex

decision making about future investments.

POLICIES

As indicated in the European Green Deal, a 90% reduction in transport

emissions is needed by 2050, to be able to achieve climate neutrality.

Road, rail, aviation and waterborne transport will all have to

contribute to the reduction [101]. The Green Deal envisages a basket of

measures to ensure shipping fairly contributes to the climate effort,

including the increased deployment of carbon neutral and sustainable

alternative fuels and the extension of the European Emissions Trading

Scheme to shipping, the revision of the Energy Taxation Directive as

well as the increased use of multimodal transport to decarbonise the

entire freight transport system. To substantially decarbonise, 75% of

inland freight carried today by road should be shifted onto rail and

inland waterways as more GHG

efficient transport modes. Automated and connected multimodal mobility

will also play an increasing role, together with digital and smart

traffic management systems, to increase efficiency. These elements will

be addressed in collaboration with other related European Partnerships

At international level, IMO's Marine Environment Protection Committee (MEPC)

adopted an initial strategy on the reduction of greenhouse gas emissions

from (seagoing) ships in April 2018, agreeing to reduce GHG emissions

from international shipping by at least 50% by 2050 compared to 2008 and

the vision to phase them out as early as possible in this century. It is

expected that even more stringent targets will be set in the

international community in the coming years. However, even at the

present level of ambition the global shipping industry will depend on

sustainable alternative fuels to be introduced quickly, and the

solutions that the Partnership will be able to deliver will also be

helpful to achieve the goals of the Strategy.

LINKS & COLLABORATION WITH OTHER PARTNERSHIPS

Coherence and collaboration with other Partnerships include (upstream):

The proposed Partnership, “Towards a competitive European industrial

battery value chain for stationary and mobile applications”, which

addresses battery development, with automotive as the largest target and

biggest market. The Batteries Partnership will also address development

for other markets, including for waterborne

transport. In this respect, it focuses on specialist battery technology,

material and manufacturing, including battery safety, whilst the

Zero-emission waterborne transport Partnership will address integration

of a battery within the ship systems and enable pre-deployment in

maritime and inland applications (addressing, for example, charging

infrastructure, certification process, etc.). This is reflected in the

proposal for Batteries and cooperation between the two Partnerships will

be maintained to ensure relevance and to generate synergies; The

proposed “Clean Hydrogen”

Partnership focuses on green hydrogen fuel production, storage and

supply, as well as some demand side technologies, such as heavy duty

road transport, where there has been substantial prior activity, as well

as the development of high-power fuel cells. The Waterborne Partnership

will address technology integration, implementation and validation, for

both maritime and inland shipping.

This includes bunkering and onboard storage of non-hydrogen alternative

fuels. It would be important to collaborate with the “Clean

Hydrogen” partnership with a view to developing the multi MW fuel

cell required for ship propulsion and the related fuel technology;

The

proposed Connected, Cooperative and Automated Mobility Partnership “CCAM”,

addresses mobility and safety for automated road transport. CCAM also

mentions potential interfaces with other transport modes. In this

context, within a zero-emission waterborne transport Partnership, any

efficiency improvements achieved through automated shipping and

maritime/river traffic management may be leveraged through synergies

with CCAM for the efficiency of the wider multimodal mobility system as

a whole;

The

proposed Partnership for “A climate neutral, sustainable and

productive Blue Economy” is focused upon resilient marine ecosystems

and marine resources, contributing to the realization of a sustainable

economy for maritime and inland waters. Waterborne transport is one of

several influencers on the marine environment and, in this respect,

cooperation between the Partnerships will be ensured. It is noted, that

the ‘Blue Economy’ is planned as a Partnership with Member State

participation, focusing on informing policy implementation. It is not

expected, as such, to develop the solutions enabling zero-emission

waterborne transport itself (e.g. new technologies, fuels, or any

relevant bunkering infrastructure).

EXISTING PARTNERSHIPS

From the existing Partnerships, there are synergies with the “Fuel

Cells and Hydrogen Joint Undertaking” (FCH

JU), which currently includes waterborne transport as one of the

applications addressed. Presently, within Horizon 2020, maritime

demonstrators developed by the FCH

JU are characterised by single technologies and small scales and do

not provide a full transferability of the solutions to the wider range

of waterborne transport products, including integration within wider

ship systems. At the next stage, within Horizon

Europe, it will be

necessary to scale up these deployments to impact on large scale

shipping and these specialist development and demonstration activities

will be undertaken within this Partnership.

EXIT CLAUSE - SUSTAINABILITY

The Partnership should pave the way for the implementation of

zero-emission waterborne transport technologies and solutions from 2030

onwards. The achievement of this goal would imply that there is no need

to extend the duration of the Partnership after the lifetime of Horizon

Europe, namely 2027 (although some projects will be granted in the last

year of Horizon Europe, which will be closed after the final calls in

2027). However, the RD&I activities related to zero emission

waterborne transport are of key interest for the Waterborne Technology

Platform and its members. The Waterborne Technology Platform will

monitor the projects co-financed by Horizon Europe until the end of

their lifetime and will form the key platform for exchanges of

information regarding RD&I activities related to the Partnership,

their implementation and possible barriers to implementation. The

organisational structure of the Partnership will stay in place until the

final project is finished, and the Waterborne TP will organise frequent

meetings with all partners (both public and private) involved in the

execution of the Partnership.

The waterborne transport sector is highly diversified and consists of

many different segments, which, in turn are comprised of many

subsegments with different interests, challenges, opportunities and

needs. This diversification is not only a wealth for the sector and

society at large, but also a bottleneck for the sector. The lack of a

clear path makes it very extremely risky for individual companies to

make investments in RD&I and the fragmented and competitive nature

of the industry results in a large number of SME

companies with limited access to research funding.

It is likely that the transition towards zero-emission waterborne

transport will require a combination of solutions, including the use of

alternative fuels, an upgrade of onshore (port) infrastructure and a

reduction of fuel demand by improving operational performance. Smart

shipping for improved energy-efficiency will play a role in reducing

fuel consumption and therefore the need for alternative fuels, as well

as emissions, whilst energy management, new propulsors and energy

storage will be other important areas of intervention. Possible

alternative fuels (depending on safety, sustainability and availability)

include conventional and advanced biofuels and bioliquids/biogases as

well as renewable synthetic and electro fuels (fuels produced through

electrolysis and chemical catalysis or biological synthesis, such as

methane (LBG), methanol, alcohols, hydrogen and ammonia (NH3)) all

strengthened in their applicability through efficiency improvements

achieved by harnessing of other renewable energy sources, such as wind

and solar.

TARGET GROUP - PARTNERSHIP COMPOSITION

A key element in transforming the waterborne transport sector is the

involvement and commitment of all relevant stakeholders. The Partnership

will involve the broad spectrum of stakeholders from the start of the

project in different ways, enabling the Partnership to interact with the

relevant stakeholders at the appropriate moment in time. The following

types of Partners will form the core membership of the Partnership:

Shipowners, as end users of the technologies and concepts developed

within the framework of the Partnership;

Ship operators, which are responsible for managing vessel performance,

bunker quality and quantity pricing and ship routing and are therefore

essential decision makers in selecting vessels with certain

technologies;

Shipbuilders, which will have a key role in retrofitting the current

fleet, as well as building zero-emission vessels;

Cargo owners, selecting the type of transport;

Equipment

suppliers, which will have an essential role in retrofitting the current

fleet, as well as developing the equipment for building zero emission

vessels;

Inland

waterway infrastructure authorities, which are essential for the

maintenance and development of inland waterway transport infrastructure;

Authorities

(international, European, national, regional, local), developing

policies, legislation and strategies and monitoring its implementation;

Academia,

crucial for scientific research;

Research

Institutes, essential players in research and testing of new

technologies and concepts;

Inland

and maritime port authorities and operators, which will provide the key

infrastructure needed to reduce emissions;

Classification

Societies, non-governmental organizations that establish and maintain

technical standards for the construction and operation of ships and

offshore structures;

Engineering

offices, essential for the design of new solutions and retrofitting;

Energy

Suppliers, which will develop energy solutions for waterborne transport;

Shipping

agents, managing port calls (representing the shipping company at ports)

and acting as cargo brokers;

Freight

forwarders and Logistics Service providers (organising and selecting the

best transport option).

GOVERNANCE

The governance presented below is based on the assumption that the

current Waterborne TP Association can be the private partner in the

Partnership. Another option would be the establishment of a separate

association, as has been done in the past for cPPPs. The development of

the governance structure also depends on the final MoU or contract

laying down the requirements of the Partnership. An ad-hoc working group

is currently exploring possible solutions to guarantee the most

efficient governance and operation for both the Waterborne TP and the

Partnership. The proposed governance scheme described below may have to

be adjusted in light of the results of this on-going work. The

Partnership will be concluded between the European Commission and the

Waterborne TP Association, representing the entire waterborne transport

community.

The

Waterborne TP is established as an Association under Belgian law with

the role of representing its members with regards to RD&I strategies

defined within its statutes. It is a membership-based organisation; it

is open to newcomers, on the basis of a small paid subscription

(€3,000 annually as of 2020). Other parties can also participate as

observers at no cost, subject to board approval; these may include civil

society organisations and representatives of national administrations.

The

Partnership will be governed by a Partnership Board. This board will

steer the Partnership towards achieving its SRIA, supervise the process

of interaction with industry and member states, approve the research

programme as set out in the SRIA and the specific topics to be addressed

in Horizon

Europe calls. The actual decision on the calls to be published is

taken following comitology procedure.

OPENNESS AND TRANSPARENCY - SECTION 2.4

Any organization that is funded with a view to funding, and charges a fee to join,

appears to violate the general

principles of Article 10 of the European Convention of Human Rights:

ARTICLE 10: "The right to receive and impart information."

Save that the Partnership claim the results, limited by the wording

"main," allows technical and other details (audit) to be

omitted for the benefit of the consortium.

Readers may then conclude that the insistence on a fee to have access to

information and financial instruments, not only violates Article 10, but

also introduces Financial Discrimination as an Article 14 violation.

In that this is a European organization, we would have expected strict

adherence to their own governing Human Rights laws. We await further

clarification. Since, the violation of these basic human rights, also

fetters the proper inclusion of SME's, as have been identified as being

out in the cold RD&I wise.

ACCESS TO INFORMATION

The Partnership will launch a dedicated website which will give an

overview of its research agenda and of ongoing and finished projects.

For finished projects, the website will detail the main results and

deliverables for everyone to use. The website will also offer the

possibility to provide feedback on the Strategic Research and Innovation

Agenda and the rolling detailed activity plans through surveys and will

show what feedback has (or has not) been taken up and why.

The

Partnership will establish a visual identity to stimulate participation

in its activities by organising conferences, workshops, social media

accounts e.g. Twitter, newsletters and press releases. As the main

European branch organisations will be taking part in the Partnership,

the broader waterborne transport community will be informed through

them, thereby ensuring an appropriate level of visibility for the

Partnership, including its visual identity.

The

Partnership will undertake actions that will increase the impact of its

activities and the supported RD&I, including ensuring broad

awareness within key bodies such as IMO and the European Sustainable

Shipping Forum.

CURRENT COMPOSITION OF THE PARTNERSHIP

Academia:

University

of Southern Denmark, DK

Aalto University Foundation, School of Engineering, FI

Kühne Logistics University, DE

Universidad de Cádiz, ES

University College London and Southampton

Marine and Maritime Institute, UK

RISE Research Institutes of Sweden, SE

WEGEMT, EU

Classification Societies:

Bureau

Veritas, FR

Lloyd's Register, UK

DNV GL, NO

RINA, IT

Energy Suppliers: European Petroleum Refiners Association, EU

Engineering: MEC Marine Engineering, EE

International Organisations: CCNR, FR

Maritime Cluster: Irish Maritime Development Office, IE.

Lighthouse, SE

Maritime Cluster Organisation: Deutsches Maritimes Zentrum

e.V., DE

Maritime Cluster Representatives: Fondazione CS Mare, IT

Maritime Equipment Manufacturer:

Wärtsilä,

Norsepower, ABB Oy Marine and Ports

One Sea Ecosystem and NAPA Safety Solutions, FI

Airseas, FR

MAN Energy Solutions and Orcan Energy AG, DE

Eekels Technology and Bosch Rexroth, NL

Kongsberg Maritime, NO

IB Marine, IT

Port Research:

Fundación Valenciaport, ES

Ports

Port of Le Havre, FR

Port of Amsterdam and Port of Rotterdam, NL

European Federation of Inland Ports (EFIP),

Federation of European private port companies

and terminals and European Sea Ports

Organisation, EU

Research:

Schiffbautechnische Versuchsanstalt in Wien, AT

Magellan Association, BE

Bulgarian Ship Hydrodynamics Centre, BG

Engitec Systems International Ltd, CY

VTT Technical Research Centre of Finland, FI

CEREMA, FR

Centre of Maritime Technologies, BALance and HSVA, DE

Centre for Research and Technology Hellas, EL

CNR and Cetena, IT

MARIN and TNO, NL

Aimen, Soermar and Fundacíon Valenciaport, ES

SSPA Sweden AB, SE

Sintef, NO

ECMAR, EU

Shipowners:

Royal Association of Netherlands Shipowners,

Van Oord, Wagenborg Shipping, Jumbo

Maritime, Spliethoff, NL

UK Chamber of Shipping, UK

Royal Belgian Shipowners Association, BE

Croatian Shipowners Association, HR

Joint Cyprus Shipowners' Association, CY

Maersk, DK

Finnish Shipowners' Association, FI

Ponant, Armateurs de France, FR

Union of Greek Shipowners, EL

Malta International Shipowners' Association, MT

The European Inland Waterway Transport

Platform, European Tugowners Association,

European Community Shipowners' Association,

European Dredging Association and CLIA,

Intercargo, EU

Shipyards:

Uljanik Shipyard Group, HR

Naval Group and Chantiers de l'Atlantique, FR

Meyer Werft Shipyard Group, MV Werften, DE

Damen Shipyard Group and Royal IHC, NL

Navantia, ES

Fincantieri and Cantiere Navale Vittoria, IT

Shipyards and Maritime Equipment Manufacturers:

Danish Maritime, DK

GICAN, FR

VSM, DE

Assonave, IT

Netherlands Maritime Technology, NL

Polish Maritime Technology Forum, PL

Associação das Indústrias Navais, PT

ANCONAV, RO

SEA Europe, EU

Waterway Authorities: Inland Navigation Europe, EU

NOTES & REFERENCE

1 https://en.wikipedia.org/wiki/Environmental_impact_of_shipping

2 https://ec.europa.eu/commission/presscorner/detail/en/ip_19_6691

3 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52018DC0773&from=EN

4 https://unfccc.int/process-and-meetings/the-parisagreement/the-paris-agreement

5 https://www.ipcc.ch/sr15/

6 http://www.imo.org/en/MediaCentre/PressBriefings/Pages/06GHGinitialstrategy.aspx

7 https://ec.europa.eu/commission/presscorner/detail/en/IP_19_6837

8 https://www.ccr-zkr.org/files/documents/dmannheim/Mannheimer_Erklaerung_en.pdf

9 http://data.consilium.europa.eu/doc/document/ST-13745-2018-INIT/en/pdf

10 http://www.europarl.europa.eu/doceo/document/B-8-2019-0079_EN.html?redirect

11 https://www.europarl.europa.eu/news/en/pressroom/20191121IPR67110/the-european-parliamentdeclares-climate-emergency

12 https://www.europarl.europa.eu/doceo/document/TA-9-2019-0078_EN.html

13 https://www.un.org/sustainabledevelopment/infrastructure-industrialization/

14 https://www.un.org/sustainabledevelopment/climatechange/

15 https://www.un.org/sustainabledevelopment/oceans/

16 https://public.wmo.int/en/media/press-release/globalclimate-2015-2019-climate-change-accelerates

17 https://unctad.org/en/PublicationsLibrary/rmt2019_en.pdf

18 An overview of relevant actions foreseen in the European Green Deal

is attached in Annex B.

19 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52018DC0773&from=EN

20 https://ec.europa.eu/clima/policies/eu-climate-action/law_en

21 https://ec.europa.eu/info/sites/info/files/europeangreen-deal-communication_en.pdf

22 https://ec.europa.eu/info/sites/info/files/cwp_2020_new_policy_objectives_factsheet_en.pdf

23 https://ec.europa.eu/environment/air/index_en.htm

24 The contracting parties to the Barcelona Convention have agreed in

December 2019 to finalise a joint and coordinated proposal to the IMO in

2022 requesting the possible designation of an ECA for sulphur oxides in

the Mediterranean Sea.

http://web.unep.org/unepmap/barcelona-convention-cop21-naples-2-5-december-2019

25 The Ambient Air Quality (2008/50/EC, as amended by

Directive (EU) 2015/1480), establishes air quality standards

for a range of pollutants, including NOx (with a specific limit value for the protection of human health set for NO2).

26 National NOx emissions are in general covered through the National

Emission Ceilings - NEC Directive (which covers national emissions

ceilings for SO2, NOx, VOC and NH3). Under the NEC Directive invites the

Commission and the Member States to pursue multilateral cooperation with

international organisations, including the IMO, to promote the

achievement of the objective of the said Directive, to limit

emissions of air pollutants from all sources

27 The Recreational Craft Directive (2013/53/EU) and Non-road Mobile

Machinery Regulation (2016/1628/EU) regulate NOx emissions from ships by

setting limit values for exhaust emissions (including NOx) for

propulsion engines of small pleasure boats (2,5-24 m long) and inland

waterway vessels in EU watercourses respectively.

28 https://www.ipcc.ch/sr15/

29 https://www.ipcc.ch/2019/09/25/srocc-press-release/

30 https://www.bloomberg.com/news/articles/2019-01-23/germany-s-dried-up-rivers-cut-growth-but-the-reboundis-coming

31 http://www.waterborne.eu/media/35860/190121-waterborne_sra_web_final.pdf

32 https://www.maersk.com/news/2018/12/04/maersk-setsnet-zero-co2-emission-target-by-2050

33 http://www.inlandnavigation.eu/media/92406/Futureproof-shipping-presentation-191016.pdf

34 https://www.ecsa.eu/news/european-shipping-industrywelcomes-european-green-deal

35 https://worldmaritimenews.com/archives/290006/cmbto-operate-zero-emission-fleet-by-2050/

36 SEA Europe, White Paper, Maritime Technology in Europe: A Strategic

Solution Provider for Major Societal Challenges, 2019

37 http://www.seaeurope.eu/ClientData/181/658/348940/3665/4/191213%20Green_Deal_Press_Release.pdf

38 https://ec.europa.eu/epsc/sites/epsc/files/epsc_cleantransport-at-sea.pdf

39 http://isdp.eu/content/uploads/2018/06/Made-in-China-Backgrounder.pdf

40 https://www.oecd.org/finance/Chinas-Belt-and-Road-Initiative-in-the-global-trade-investment-and-financelandscape.pdf

41 SEA Europe, White Paper, Maritime Technology in Europe: A Strategic

Solution Provider for Major Societal Challenges, 2019

42 https://ec.europa.eu/transport/modes/maritime_en

43 https://ec.europa.eu/transport/modes/maritime_en

44 https://ec.europa.eu/epsc/sites/epsc/files/epsc_cleantransport-at-sea.pdf

45 Internal Wärtsilä calculations based on proprietary Clarksons data.

46 https://ec.europa.eu/clima/news/commission-publishesinformation-co2-emissions-maritime-transport_en

47 https://www.transportenvironment.org/sites/te/files/publications/Study-EU_shippings_climate_record_20191209_final.pdf

48 https://theicct.org/news/study-global-shippingemissions-rise

49 https://ec.europa.eu/clima/news/commission-publishesinformation-co2-emissions-maritime-transport_en

50 https://mrv.emsa.europa.eu/#public/emission-report

51 https://www.cedelft.eu/en/publications/2056/updateof-maritime-greenhouse-gas-emission-projections

52 http://www.imo.org/en/OurWork/Environment/PollutionPrevention/AirPollution/Documents/Third%20Greenhouse%20Gas%

53 COM(2013) 918 final ‘ Communication from the Commission to the

European Parliament, the Council, the European Economic and Social

Committee and the Committee of the Regions - a Clean Air Programme for

Europe’

54 The potential for cost effective air emission reductions from

international shipping through designation of further Emission Control

Areas in EU waters with focus on the Mediterranean Sea.” http://www.iiasa.ac.at/web/home/research/researchPrograms/air/Shipping_emissions_reductions_main.pdf

55 https://ec.europa.eu/info/sites/info/files/europeangreen-deal-communication_en.pdf

56 E.g. IMO, IAEA, UNFCC, IACS, ISO

57 E.g. ERDF, HELCOM, OSPAR, Barcelona Convention and other regional

organisations

58 E.g. Maersk, the world’s largest container shipping company, has

pledged to operate carbon neutral vessels from 2030

59 http://www.imo.org/en/OurWork/Environment/PollutionPrevention/AirPollution/Pages/Greenhouse-Gas-Studies-2014.aspx

60 https://en.wikipedia.org/wiki/Environmental_impact_of_shipping

61 https://www.theguardian.com/environment/2009/apr/09/shipping-pollution

62 https://www.iiasa.ac.at/web/home/research/researchPrograms/air/Shipping_emissions_reductions_main.pdf

63 In accordance with Directive 2008/56/EC establishing a framework for

community action in the field of marine environmental policy (Marine

Strategy Framework Directive), Member States have to achieve good

environmental status of their marine waters by 2020. This includes,

according to one of the 'descriptors' provided in the Directive, EU

rules on different sectors or modes of transport. It is important to

note that the same Directive gives an indicative list of pressures and

impact that should be taken into account to guide progress towards

establishing a good environmental status – and one of the pressures

specifically referred to in its Annex III is shipping.

64

Source PROMINENT Deliverable D6.3&D6.5

65 CE Delft, Update of Maritime Greenhouse Gas Emission Projections,

2019

66 https://www.marineinsight.com/main-engine/the-mostpopular-marine-propulsion-engines-in-the-shippingindustry/

67 https://www.eea.europa.eu/data-and-maps/indicators/transport-emissions-of-air-pollutants-8/transportemissions-of-air-pollutants-8

68 https://www.iiasa.ac.at/web/home/research/researchPrograms/air/Shipping_emissions_reductions_main.pdf

69 https://www.iiasa.ac.at/web/home/research/researchPrograms/air/Shipping_emissions_reductions_main.pdf

70 https://worldmaritimenews.com/archives/205936/imodesignates-north-sea-baltic-sea-as-neca/

71 https://ec.europa.eu/transport/modes/inland_en

72 https://ec.europa.eu/inea/en/horizon-2020/projects/h2020-transport/waterborne/prominent

73 Source PROMINENT Deliverable D6.3&D6.5

74 Applied shadow prices (2018): NOx:16,192 euro/ton, Ricardo-AEA Update

Handbook External costs of Transport, EC DG MOVE, 2014 PM: 63,778

euro/ton, Ricardo-AEA Update Handbook External costs of Transport, EC DG

MOVE, 2014 CO2: 33 euro/ton, Guide CBA DG Regio

75 https://ec.europa.eu/environment/marine/eu-coastand-

marine-policy/marine-strategy-framework-directive/index_en.htm

76 Review of the 2015 guidelines for exhaust gas cleaningsystems

(Resolution MEPC.259(68))

77 http://www.imo.org/en/OurWork/Environment/BallastWaterManagement/Pages/Default.aspx

78 https://clearseas.org/en/blog/importance-ballast-watermanagement/

79 https://clearseas.org/en/blog/importance-ballast-watermanagement/

80 https://www.researchgate.net/publication/271179593_Marine_Fouling_An_Overview/link/54bf69850cf28ce68e6b4e8d/download

81 Oxford Economics, The Economic Value of the EU Shipping Industry

(London, Oxford Economics, 2020)

82 Oxford Economics, The Economic Value of the EU shipping industry,

(London, Oxford Economics, 2020)

83 https://ec.europa.eu/epsc/sites/epsc/files/epsc_cleantransport-at-sea.pdf

84 In comparison, SEA Europe member countries generate an annual average

production value of €47.1 billion and employ 313,000 people. See

BALance, “European Shipbuilding Supply Chain Statistics”, May 2019.

85 https://ec.europa.eu/transport/modes/maritime/ports/ports_en

86 https://ec.europa.eu/epsc/publications/strategic-notes/clean-transport-sea_en

87 https://eu2020.hr/Home/OneNews?id=210

88 https://irena.org/-/media/Files/IRENA/Agency/Publication/2019/Sep/IRENA_Renewable_Shipping_Sep_2019.pdf

89 http://www.waterborne.eu/media/35860/190121-waterborne_sra_web_final.pdf

90 http://www.inlandnavigation.eu/media/88852/SRANOTES20190121.pdf

91 http://www.waterborne.eu/media/100202/191122-waterborne-technical-research-agenda_ss_final.pdf

92 https://ec.europa.eu/transport/sites/transport/files/studies/internalisation-study-exec-summaryisbn-978-92-76-03080-5.pdf

93 https://ec.europa.eu/transport/modes/maritime_en

94 https://ec.europa.eu/transport/modes/inland_en

95 Inland Navigation Europe

96 https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Gross-gross_weight

97 https://cruising.org/-/media/research-updates/research/economic-impact-studies/contribution-of-cruise-tourismto-the-economies-of-europe-2017.pdf

98 Maritime Technology Sector in Europe: A Strategic Solution Provider

for Major Societal Challenges, SEA Europe, 2019

99 https://www.nature.com/articles/s41467-017-02774-9.epdf?shared_access_token=zdv4XaDHZS6x19r_

X6YC79RgN0jAjWel9jnR3ZoTv0Px8RutgA7iuV6ZM8RzZ7iaqYBGD8a47j9LNwEwIIzUznILKkm8PU-ZT

JK413bybPUHBbHoQKfzgs9rjNos2FiNsXgvL_it_5p5LewsdP20AEWBJxbXKeW9uIwJmQLlGr8%3D

100 https://www.globalmaritimeforum.org/news/the-scaleof-investment-needed-to-decarbonize-internationalshipping/

101 https://ec.europa.eu/info/sites/info/files/europeangreen-deal-communication_en.pdf

102 https://ec.europa.eu/clima/policies/innovation-fund_ en#tab-0-0

103 https://ec.europa.eu/info/sites/info/files/innovation_and_modernisation_fund_ema.pdf

104 https://ec.europa.eu/inea/connecting-europe-facility/cef-transport

105 https://ec.europa.eu/inea/en/connecting-europefacility/cef-transport/apply-funding/blending-facility

106 https://ec.europa.eu/regional_policy/en/funding/erdf/

107 https://ec.europa.eu/commission/news/investmentplan-europe-ing-and-eib-provide-eu110m-spliethoffsgreen-shipping-investments-2019-feb-28_en

108 https://ec.europa.eu/easme/en/section/life/lifelegal-basis

109 https://irena.org/-/media/Files/IRENA/Agency/Publication/2019/Sep/IRENA_Renewable_Shipping_Sep_2019.pdf

110 https://www.ecsa.eu/news/ecsa-supportsestablishment-co-programmed-partnership-zeroemission-waterborne-transport

111 Developed in the Strategic Research and Innovation Agenda.

112 SRIAto be finalised by end of summer 2020

113 Such as the IMO, ESSF, EPF (European Ports Forum), CCNR, CESNI,

Naiades II implementation group etc.

114 http://www.inlandnavigation.eu/media/88852/SRA-20190121.pdf

115 https://www.martera.eu/start

116 http://www.waterborne.eu/media/87917/190501-pressrelease-waterborne-tp-hydrogen-based-fuels-and-thewaterborne-transport-sector.pdf

117 http://www.waterborne.eu/media/100199/191126-pressrelease-waterborne-tp-the-future-of-the-europeanwaterborne-transport-sector.pdf

1

https://en.wikipedia.org/wiki/Environmental_impact_of_shipping

2 https://ec.europa.eu/commission/presscorner/detail/en/ip_19_6691

3 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52018DC0773&from=EN

4 https://unfccc.int/process-and-meetings/the-parisagreement/the-paris-agreement

5 https://www.ipcc.ch/sr15/

6 http://www.imo.org/en/MediaCentre/PressBriefings/Pages/06GHGinitialstrategy.aspx

7 https://ec.europa.eu/commission/presscorner/detail/en/IP_19_6837

8 https://www.ccr-zkr.org/files/documents/dmannheim/Mannheimer_Erklaerung_en.pdf

9 http://data.consilium.europa.eu/doc/document/ST-13745-2018-INIT/en/pdf

10 http://www.europarl.europa.eu/doceo/document/B-8-2019-0079_EN.html?redirect

11 https://www.europarl.europa.eu/news/en/pressroom/20191121IPR67110/the-european-parliamentdeclares-climate-emergency

12 https://www.europarl.europa.eu/doceo/document/TA-9-2019-0078_EN.html

13 https://www.un.org/sustainabledevelopment/infrastructure-industrialization/

14 https://www.un.org/sustainabledevelopment/climatechange/

15 https://www.un.org/sustainabledevelopment/oceans/

16 https://public.wmo.int/en/media/press-release/globalclimate-2015-2019-climate-change-accelerates

17 https://unctad.org/en/PublicationsLibrary/rmt2019_en.pdf

18 An overview of relevant actions foreseen in the European Green Deal

is attached in Annex B.

19 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52018DC0773&from=EN

20 https://ec.europa.eu/clima/policies/eu-climate-action/law_en

21 https://ec.europa.eu/info/sites/info/files/europeangreen-deal-communication_en.pdf

22 https://ec.europa.eu/info/sites/info/files/cwp_2020_new_policy_objectives_factsheet_en.pdf

23 https://ec.europa.eu/environment/air/index_en.htm

24 The contracting parties to the Barcelona Convention have agreed in

December 2019 to finalise a joint and coordinated proposal to the IMO in

2022 requesting the possible designation of an ECA for sulphur oxides in

the Mediterranean Sea.

http://web.unep.org/unepmap/barcelona-convention-cop21-naples-2-5-december-2019

25 The Ambient Air Quality (2008/50/EC, as amended by

Directive (EU) 2015/1480), establishes air quality standards

for a range of pollutants, including NOx (with a specific

limit value for the protection of human health set for NO2).

26 National NOx emissions are in general covered through the National

Emission Ceilings - NEC Directive (which covers national emissions

ceilings for SO2, NOx, VOC and NH3). Under the NEC Directive invites the

Commission and the Member States to pursue multilateral cooperation with

international organisations, including the IMO, to promote the

achievement of the objective of the said Directive, which is to limit

emissions of air pollutants from all sources

27 The Recreational Craft Directive (2013/53/EU) and Non-road Mobile

Machinery Regulation (2016/1628/EU) regulate NOx emissions from ships by

setting limit values for exhaust emissions (including NOx) for

propulsion engines of small pleasure boats (2,5-24 m long) and inland

waterway vessels in EU watercourses respectively.

28 https://www.ipcc.ch/sr15/

29 https://www.ipcc.ch/2019/09/25/srocc-press-release/

30 https://www.bloomberg.com/news/articles/2019-01-23/germany-s-dried-up-rivers-cut-growth-but-the-reboundis-coming

31 http://www.waterborne.eu/media/35860/190121-waterborne_sra_web_final.pdf

32 https://www.maersk.com/news/2018/12/04/maersk-setsnet-zero-co2-emission-target-by-2050

33 http://www.inlandnavigation.eu/media/92406/Futureproof-shipping-presentation-191016.pdf

34 https://www.ecsa.eu/news/european-shipping-industrywelcomes-european-green-deal

35 https://worldmaritimenews.com/archives/290006/cmbto-operate-zero-emission-fleet-by-2050/

36 SEA Europe, White Paper, Maritime Technology in Europe: A Strategic

Solution Provider for Major Societal Challenges, 2019

37 http://www.seaeurope.eu/ClientData/181/658/348940/3665/4/191213%20Green_Deal_Press_Release.pdf

38 https://ec.europa.eu/epsc/sites/epsc/files/epsc_cleantransport-at-sea.pdf

39 http://isdp.eu/content/uploads/2018/06/Made-in-China-Backgrounder.pdf

40 https://www.oecd.org/finance/Chinas-Belt-and-Road-Initiative-in-the-global-trade-investment-and-financelandscape.pdf

41 SEA Europe, White Paper, Maritime Technology in Europe: A Strategic

Solution Provider for Major Societal Challenges, 2019

42 https://ec.europa.eu/transport/modes/maritime_en

43 https://ec.europa.eu/transport/modes/maritime_en

44 https://ec.europa.eu/epsc/sites/epsc/files/epsc_cleantransport-at-sea.pdf

45 Internal Wärtsilä calculations based on proprietary Clarksons data.

46 https://ec.europa.eu/clima/news/commission-publishesinformation-co2-emissions-maritime-transport_en

47 https://www.transportenvironment.org/sites/te/files/publications/Study-EU_shippings_climate_record_20191209_final.pdf

48 https://theicct.org/news/study-global-shippingemissions-rise

49 https://ec.europa.eu/clima/news/commission-publishesinformation-co2-emissions-maritime-transport_en

50 https://mrv.emsa.europa.eu/#public/emission-report

51 https://www.cedelft.eu/en/publications/2056/updateof-maritime-greenhouse-gas-emission-projections

52 http://www.imo.org/en/OurWork/Environment/PollutionPrevention/AirPollution/Documents/Third%20

Greenhouse%20Gas%20Study/GHG3%20Executive%20Summary%20and%20Report.pdf

53 COM(2013) 918 final ‘ Communication from the Commission to the

European Parliament, the Council, the European Economic and Social

Committee and the Committee of the Regions - a Clean Air Programme for

Europe’

54 The potential for cost effective air emission reductions from

international shipping through designation of further Emission Control

Areas in EU waters with focus on the Mediterranean Sea.” http://www.iiasa.ac.at/web/home/research/researchPrograms/air/Shipping_emissions_reductions_main.pdf

55 https://ec.europa.eu/info/sites/info/files/europeangreen-deal-communication_en.pdf

56 E.g. IMO, IAEA, UNFCC, IACS, ISO

57 E.g. ERDF, HELCOM, OSPAR, Barcelona Convention and other regional

organisations

58 E.g. Maersk, the world’s largest container shipping company, has

pledged to operate carbon neutral vessels from 2030

59 http://www.imo.org/en/OurWork/Environment/PollutionPrevention/AirPollution/Pages/Greenhouse-Gas-Studies-2014.aspx

60 https://en.wikipedia.org/wiki/Environmental_impact_of_shipping

61 https://www.theguardian.com/environment/2009/apr/09/shipping-pollution

62 https://www.iiasa.ac.at/web/home/research/researchPrograms/air/Shipping_emissions_reductions_main.pdf

63 In accordance with Directive 2008/56/EC establishing a framework for

community action in the field of marine environmental policy (Marine

Strategy Framework Directive), Member States have to achieve good

environmental status of their marine waters by 2020. This includes,

according to one of the 'descriptors' provided in the Directive, EU

rules on different sectors or modes of transport. It is important to

note that the same Directive gives an indicative list of pressures and

impact that should be taken into account to guide progress towards

establishing a good environmental status – and one of the pressures

specifically referred to in its Annex III is shipping.

64

Source PROMINENT Deliverable D6.3&D6.5

65 CE Delft, Update of Maritime Greenhouse Gas Emission Projections,

2019

66 https://www.marineinsight.com/main-engine/the-mostpopular-marine-propulsion-engines-in-the-shippingindustry/

67 https://www.eea.europa.eu/data-and-maps/indicators/transport-emissions-of-air-pollutants-8/transportemissions

of-air-pollutants-8

68 https://www.iiasa.ac.at/web/home/research/researchPrograms/air/Shipping_emissions_reductions_main.pdf

69 https://www.iiasa.ac.at/web/home/research/researchPrograms/air/Shipping_emissions_reductions_main.pdf

70 https://worldmaritimenews.com/archives/205936/imodesignates-north-sea-baltic-sea-as-neca/

71 https://ec.europa.eu/transport/modes/inland_en

72 https://ec.europa.eu/inea/en/horizon-2020/projects/h2020-transport/waterborne/prominent

73 Source PROMINENT Deliverable D6.3&D6.5

74 Applied shadow prices (2018): NOx:16,192 euro/ton, Ricardo-AEA Update

Handbook External costs of Transport, EC DG MOVE, 2014 PM: 63,778

euro/ton, Ricardo-AEA Update Handbook External costs of Transport, EC DG

MOVE, 2014 CO2: 33 euro/ton, Guide CBA DG Regio

75 https://ec.europa.eu/environment/marine/eu-coastand-

marine-policy/marine-strategy-framework-directive/index_en.htm

76 Review of the 2015 guidelines for exhaust gas cleaningsystems

(Resolution MEPC.259(68))

77 http://www.imo.org/en/OurWork/Environment/BallastWaterManagement/Pages/Default.aspx

78 https://clearseas.org/en/blog/importance-ballast-watermanagement/

79 https://clearseas.org/en/blog/importance-ballast-watermanagement/

80 https://www.researchgate.net/publication/271179593_Marine_Fouling_An_Overview/link/54bf69850cf28ce68e6b4e8d/download

81 Oxford Economics, The Economic Value of the EU Shipping Industry

(London, Oxford Economics, 2020)

82 Oxford Economics, The Economic Value of the EU shipping industry,

(London, Oxford Economics, 2020)

83 https://ec.europa.eu/epsc/sites/epsc/files/epsc_cleantransport-at-sea.pdf

84 In comparison, SEA Europe member countries generate an annual average

production value of €47.1 billion and employ 313,000 people. See

BALance, “European Shipbuilding Supply Chain Statistics”, May 2019.

85 https://ec.europa.eu/transport/modes/maritime/ports/ports_en

86 https://ec.europa.eu/epsc/publications/strategic-notes/clean-transport-sea_en

87 https://eu2020.hr/Home/OneNews?id=210

88 https://irena.org/-/media/Files/IRENA/Agency/Publication/2019/Sep/IRENA_Renewable_Shipping_Sep_2019.pdf

89 http://www.waterborne.eu/media/35860/190121-waterborne_sra_web_final.pdf

90 http://www.inlandnavigation.eu/media/88852/SRANOTES20190121.pdf

91 http://www.waterborne.eu/media/100202/191122-waterborne-technical-research-agenda_ss_final.pdf

92 https://ec.europa.eu/transport/sites/transport/files/studies/internalisation-study-exec-summaryisbn-978-92-76-03080-5.pdf

93 https://ec.europa.eu/transport/modes/maritime_en

94 https://ec.europa.eu/transport/modes/inland_en

95 Inland Navigation Europe

96 https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Gross-gross_weight

97 https://cruising.org/-/media/research-updates/research/economic-impact-studies/contribution-of-cruise-tourismto-the-economies-of-europe-2017.pdf

98 Maritime Technology Sector in Europe: A Strategic Solution Provider

for Major Societal Challenges, SEA Europe, 2019

99 https://www.nature.com/articles/s41467-017-02774-9.epdf?shared_access_token=zdv4XaDHZS6x19r_

X6YC79RgN0jAjWel9jnR3ZoTv0Px8RutgA7iuV6ZM8RzZ7iaqYBGD8a47j9LNwEwIIzUznILKkm8PU-ZT

JK413bybPUHBbHoQKfzgs9rjNos2FiNsXgvL_it_5p5LewsdP20AEWBJxbXKeW9uIwJmQLlGr8%3D

100 https://www.globalmaritimeforum.org/news/the-scaleof-investment-needed-to-decarbonize-internationalshipping/

101 https://ec.europa.eu/info/sites/info/files/europeangreen-deal-communication_en.pdf

102 https://ec.europa.eu/clima/policies/innovation-fund_ en#tab-0-0

103 https://ec.europa.eu/info/sites/info/files/innovation_and_modernisation_fund_ema.pdf

104 https://ec.europa.eu/inea/connecting-europe-facility/cef-transport

105 https://ec.europa.eu/inea/en/connecting-europefacility/cef-transport/apply-funding/blending-facility

106 https://ec.europa.eu/regional_policy/en/funding/erdf/

107 https://ec.europa.eu/commission/news/investmentplan-europe-ing-and-eib-provide-eu110m-spliethoffsgreen-shipping-investments-2019-feb-28_en

108 https://ec.europa.eu/easme/en/section/life/lifelegal-basis

109 https://irena.org/-/media/Files/IRENA/Agency/Publication/2019/Sep/IRENA_Renewable_Shipping_Sep_2019.pdf

110 https://www.ecsa.eu/news/ecsa-supportsestablishment-co-programmed-partnership-zeroemission-waterborne-transport

111 Developed in the Strategic Research and Innovation Agenda.

112 SRIAto be finalised by end of summer 2020

113 Such as the IMO, ESSF, EPF (European Ports Forum), CCNR, CESNI,

Naiades II implementation group etc.

114 http://www.inlandnavigation.eu/media/88852/SRA-20190121.pdf

115 https://www.martera.eu/start

116 http://www.waterborne.eu/media/87917/190501-pressrelease-waterborne-tp-hydrogen-based-fuels-and-thewaterborne-transport-sector.pdf

117 http://www.waterborne.eu/media/100199/191126-pressrelease-waterborne-tp-the-future-of-the-europeanwaterborne-transport-sector.pdf

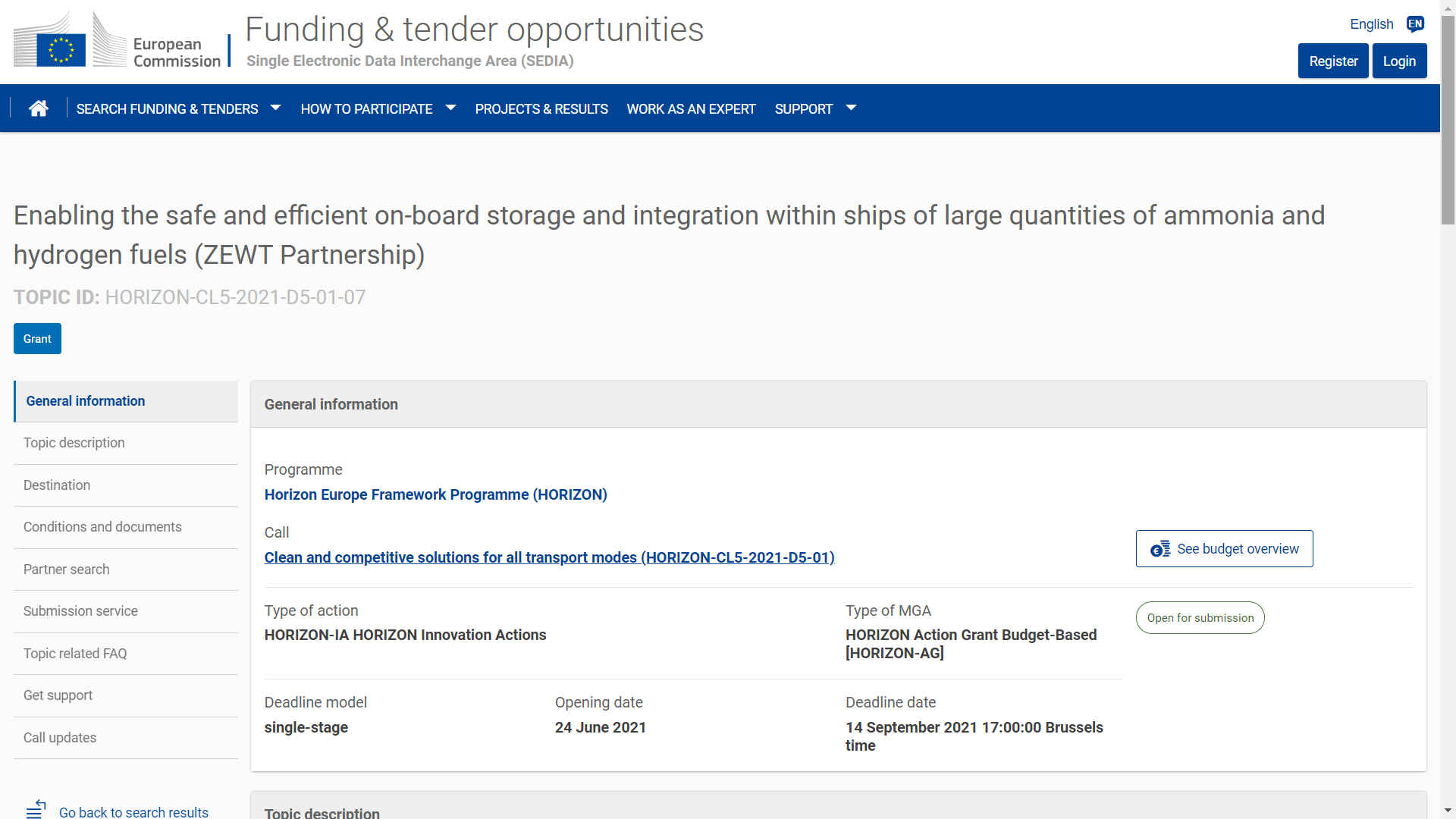

Cross-cutting Priorities:

Co-programmed European Partnerships

Ocean sustainability and blue economy

CLEAN AND COMPETITIVE SOLUTIONS FOR ALL TRANSPORT MODES

This Destination addresses activities that improve the climate and environmental footprint, as well as competitiveness, of different transport modes.